Navigating Personal Loans: Tips for Borrowing Responsibly

Are you in requirement of some added cash? Prior to diving right into the world of personal financings, it's essential to comprehend just how to navigate this monetary tool responsibly. In this post, we will certainly provide you with beneficial pointers and guidance on obtaining money in a method that matches your demands and also monetary situation. By following these standards, you can make educated choices, discover the right loan provider, and handle your personal loan successfully. Allow's get going!

Understanding the Various Sorts Of Individual Loans

There's a variety of individual loans offered, so it is necessary to understand the various types before borrowing. Individual fundings can be a valuable economic device when used sensibly. The first type of personal lending is an unsecured loan. As the name recommends, this sort of funding does not call for security. It is based entirely on your creditworthiness. Unsafe finances appropriate for smaller sized quantities as well as have greater rate of interest compared to protected fundings. On the other hand, if you need a bigger sum of money, you may think about a secured car loan. These finances are backed by collateral, such as your automobile or home. Safeguarded lendings typically have reduced interest rates as well as longer payment terms due to the fact that of the security. Another kind of individual funding is a fixed-rate lending. With this sort of finance, the interest rate remains the very same throughout the life of the finance. This gives stability and also predictability in your month-to-month repayments. You might decide for a variable-rate loan. The rate of interest on these fundings can fluctuate based upon market conditions, which implies your month-to-month settlements may differ. It's crucial to thoroughly consider the benefits and drawbacks of each kind of individual finance before choosing. By recognizing the various types of personal finances, you can choose the one that ideal fits your economic requirements as well as goals.

Assessing Your Financial Circumstance as well as Requirements

To precisely analyze your monetary scenario and also requires, take a more detailed check out your earnings, expenditures, and future goals. Comprehending where your money is originating from and where it's going is crucial in making educated choices regarding borrowing sensibly. Begin by examining your revenue resources, such as your wage, financial investments, or any kind of extra resources of earnings. Compute your month-to-month revenue and determine if it covers all your expenditures, including needs like rental fee, utilities, groceries, and transport. If needed, it's crucial to be truthful with on your own concerning your costs behaviors and also recognize areas where you can reduce back.

Next off, assess your costs and classify them right into taken care of and also variable expenses. Fixed expenses are those that remain consistent monthly, like rental fee or vehicle repayments. Variable expenses, on the various other hand, vary, such as eating out or enjoyment costs. By comprehending your costs, you can identify locations where you can potentially save money and also have a clearer photo of just how much you can afford to borrow.

It's vital to aspect in these future objectives when evaluating your monetary circumstance. By comprehending your income, costs, and future objectives, you can make a more educated choice regarding whether or not to take out an individual car loan as well as just how much you can conveniently obtain without placing excessive stress on your funds.

Researching as well as Contrasting Lenders and also Funding Options

When researching and also contrasting lenders and lending choices, you must consider variables such as interest link prices, settlement terms, as well as any extra charges that might be connected with the funding. It is very important to do your due persistance in order to discover the most effective loan choice that suits your requirements and financial scenario.

A lower interest price can conserve you a considerable amount of cash over the life of the funding. Dealt with prices stay the same throughout the loan term, while variable prices may fluctuate.

Next off, take a look at the repayment terms. Figure out the length of the lending and also the regular monthly payment quantity. Longer car loan terms might lead to lower monthly payments, yet you might end up paying extra in passion in time. Consider what jobs best for your budget and also monetary objectives.

Be mindful of any type of additional charges linked with the financing. These can include origination charges, early repayment charges, or late settlement charges. These fees can build up and influence the overall cost of the lending.

Obtaining an Individual Finance: Tips as well as Considerations

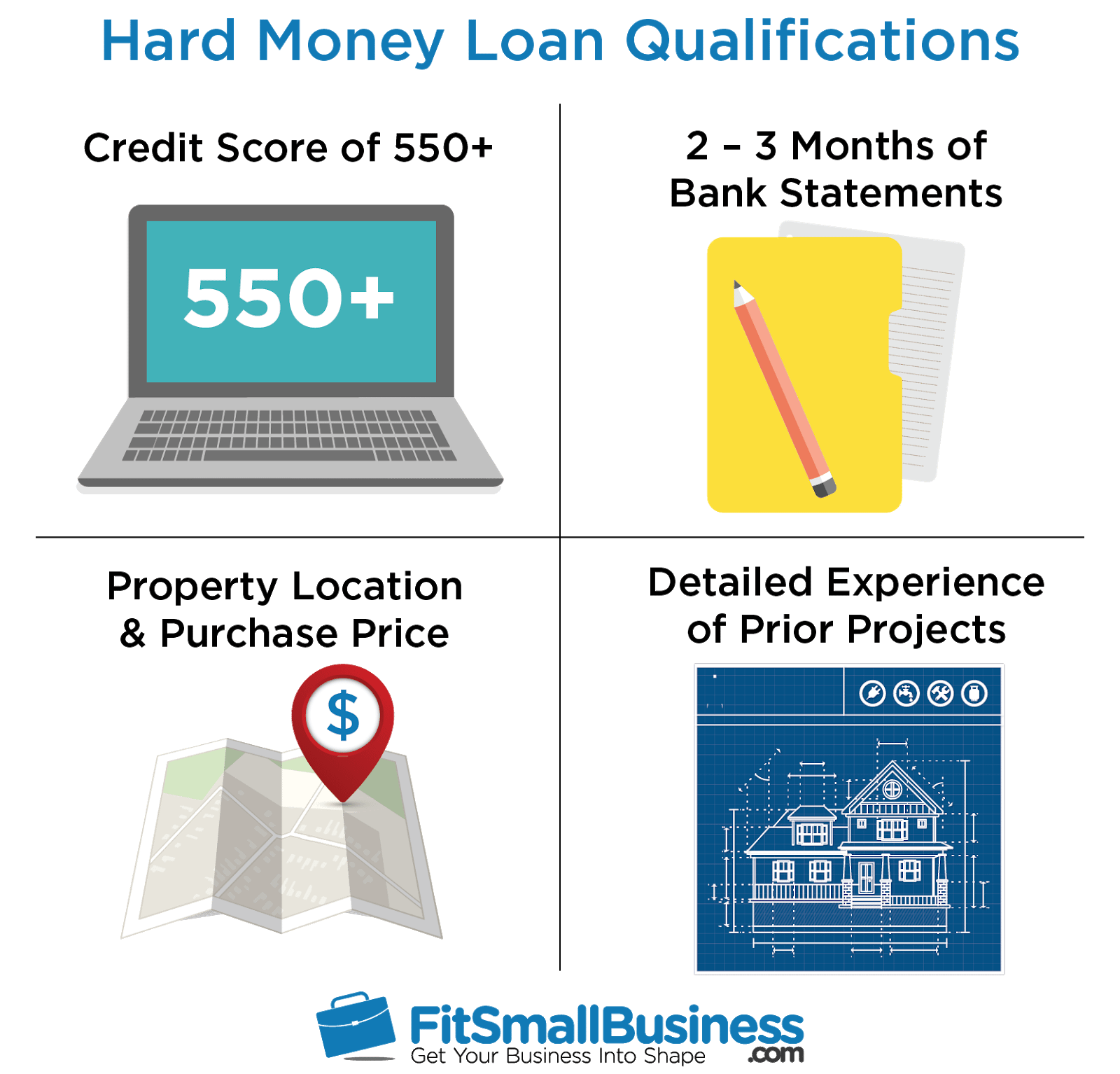

Start by gathering all the essential documentation, such as proof of revenue, work history, as well as credit history score, before you apply for an individual funding. You can use for an individual lending online or at a regional financial institution or credit union (hard money lender atlanta). Make sure to very carefully review the car loan terms, consisting of passion rates, payment duration, and also any type of charges or fees.

Taking care of as well as Settling Your Personal Loan Sensibly

Make certain you spending plan and also prioritize your month-to-month expenditures to guarantee you can make timely finance payments and manage your personal loan responsibly. When it comes to repaying your personal financing, it's important to remain arranged and also disciplined.

If you locate yourself struggling to make your finance settlement, do not overlook the concern. It's always better to interact with your loan provider and also function out a solution instead than failing on your loan.

Handling as well as settling your individual loan properly is not only essential for your monetary wellness, yet it additionally assists construct a favorable credit score background. By making timely repayments, you show to lending institutions that you are a liable consumer, which can enhance your possibilities of acquiring future debt at desirable terms. So, remain on top of your monthly expenditures, make your financing settlements a priority, and connect with your loan provider if you need aid.

Verdict

:max_bytes(150000):strip_icc()/GettyImages-1137516784-604537c07dad40eea021db81f5527ecf.jpg)

The initial kind of personal car loan is an unprotected financing. Unsafe fundings are ideal for smaller quantities and also have higher rate of interest prices contrasted to secured finances. An additional kind of individual funding is a fixed-rate car loan. Make sure you spending her response plan and prioritize your regular monthly expenses to ensure you can make prompt finance settlements as well as handle your individual funding sensibly. As soon as you've a fantastic read protected a funding, make certain to handle your funds intelligently as well as repay your car loan on time.